This note from BN Americas really rams home the difference between a nationalized company and a private company. Chile's Codelco, the world's largest copper producer, will match 2008 capex next year to the tune of U$2Bn. In the words of big cheese José Pablo Arellano;

"The investment plan is comparable to the one last year.....We expect to go ahead with a vigorous investment plan next year in spite of this difficult situation"

Or in other words, while the rest of the sector tucks, trims, cuts and slashes spending, Codelco rolls on as usual. Y'see, the whole mindset of a country-controlled company is different. Bottom line profits come down the list of priorities (as long as the company adds to GDP and pays its tax and royalty bills the State won't moan so very much). In the case of Codelco it may be a hypothetical for you, dear investor. However here's an extract from something I wrote in this post back in early September about Petrobras:

It's at this point the plain, boring, simple fact that Petrobras is a state run company needs emphasizing. Bottom line results are not the be-all-and-end-all of PBR's corporate philosophy. Never have been and never will be. Do you honestly believe that the company will continue to pay enormous dividends to foreign shareholders while at the same time taking out massive debt lines to pay for the capex? If so, you are in for a rude awakening.

On rude awakening later.....

.....so with Petrobras due to spend $20Bn or so in Capex next year, don't expect the company to leave much for dividends next year. Not with oil at $50, anyway.

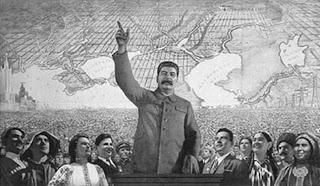

But the funniest thing now is listening to the 15,000 or so professional economists registered in the USA. Due to the total failure of everything they've taught and been taught for the last 15 years, suddenly nationalization is good, beneficial and acceptable. Have you noted that phrase "counter-cyclical" being used more often in polite society, too? So expect Chile's Codelco to get plenty of praise for forging ahead with its expansion plans. And expect analysts to concur with PBR's vision for adding GDP growth to its parent, Brazil. But don't expect a single good word for Venezuela's PdVSA or Bolivia's YPFB or Ecuador's PetroEcuador. I mean...waddya think we are....a buncha of commie bedwetters?

"The investment plan is comparable to the one last year.....We expect to go ahead with a vigorous investment plan next year in spite of this difficult situation"

Or in other words, while the rest of the sector tucks, trims, cuts and slashes spending, Codelco rolls on as usual. Y'see, the whole mindset of a country-controlled company is different. Bottom line profits come down the list of priorities (as long as the company adds to GDP and pays its tax and royalty bills the State won't moan so very much). In the case of Codelco it may be a hypothetical for you, dear investor. However here's an extract from something I wrote in this post back in early September about Petrobras:

It's at this point the plain, boring, simple fact that Petrobras is a state run company needs emphasizing. Bottom line results are not the be-all-and-end-all of PBR's corporate philosophy. Never have been and never will be. Do you honestly believe that the company will continue to pay enormous dividends to foreign shareholders while at the same time taking out massive debt lines to pay for the capex? If so, you are in for a rude awakening.

On rude awakening later.....

.....so with Petrobras due to spend $20Bn or so in Capex next year, don't expect the company to leave much for dividends next year. Not with oil at $50, anyway.

But the funniest thing now is listening to the 15,000 or so professional economists registered in the USA. Due to the total failure of everything they've taught and been taught for the last 15 years, suddenly nationalization is good, beneficial and acceptable. Have you noted that phrase "counter-cyclical" being used more often in polite society, too? So expect Chile's Codelco to get plenty of praise for forging ahead with its expansion plans. And expect analysts to concur with PBR's vision for adding GDP growth to its parent, Brazil. But don't expect a single good word for Venezuela's PdVSA or Bolivia's YPFB or Ecuador's PetroEcuador. I mean...waddya think we are....a buncha of commie bedwetters?