Any questions?

Sunday, May 31, 2009

Foreign Direct Investment in Latin America, 2008

Any questions?

The IKN Weekly, issue 5, out now

Meanwhile, if you're not signed on yet all is not lost. Get your sub in before the bell in New York tomorrow (buttons on the right of the blog over there...yeah that's them) and you get this week's edition, no problem. At 21 pages it'll fill up your Sunday evening for sure and newbies also get IKN1 to know more about the parameters of the service.

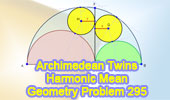

Problem 295: Archimedean Twin Circles, Arbelos, Semicircles, Harmonic Mean, Radii, Perpendicular

Click the figure below to see the complete problem 295 about Archimedean Twin Circles, Arbelos, Semicircles, Harmonic Mean, Radii, Perpendicular, Diameter.

See also:

Complete Problem 295

Collection of Geometry Problems

Level: High School, SAT Prep, College geometry

Saturday, May 30, 2009

The late night Saturday chart of the day is.....

Sooooo..... he gets 59% approval with the socioeconomic A level of society, and 30% rating (down two points since last month) from all socioeconomic groups including the As. Go on, take a wild guess as to what all that points to.....

Sooooo..... he gets 59% approval with the socioeconomic A level of society, and 30% rating (down two points since last month) from all socioeconomic groups including the As. Go on, take a wild guess as to what all that points to.....Meanwhile, from the same news report where I culled the numbers, take a look at this opinion about Chile's recent purchase of arms. After you read it, have a look at who actually said it below. These are the people forming public opinion and running the all-white criollo show in Peru, folks. Frightening.

"The arms that Chile is buying is to prepare an attack against us. Chile has alwas tried to take over Peruvian territory. In Perú, on the other hand, we don't buy arms for expansionary reasons or for attack. The reason has always been for dissuasive purposes, and this is the spirit that is reflected in the survey. What we need is a real policy of national defence to dissuade any possible aggressor. This will also be used to confront internal dangers such as narcotrafficking so that the population can develop peacefully."The man behind those words is Rear-Admiral Alfonzo Paniza who was head of the Peruvian Intelligence Service (CNI) on two occasions. He lost his job in 2003 when he was discovered using his spooks to track journalists.

Soddy Circles and Descartes Theorem

Click the figure below to see the complete illustration.

See also:

Complete Soddy Circles and Descartes Theorem

Collection of Geometry Problems

Circle, Theorems and Problems

Level: High School, SAT Prep, College geometry

the 4th Summit of the Indigenous Peoples of the Americas

Evo Morales was invited to speak but had to apologize due to previous commitments (for one thing he's travelling to the inauguration of Mauricio Funes in El Salvador). But he did write a letter to the conference that was read out by his representative there. The whole thing (Spanish language) can be read here, but I want to translate a part because it really captures what is happening in many parts of South America in relation to business and investments. There's a lesson for all those who are considering making money in the Americas, but as mining is often the leading edge in capital investments the lesson is particulary acute for that sector.

The lesson is; either make a fair deal for all or don't bother coming. Don't think you can shake hands with the national government and ignore the locals. What's happening with oil exploration in the Amazon Basin of Peru is a topical example of a trend that is not going to suddenly disappear; on the contrary, it's going to grow stronger and stronger. (Side note; the speech is already being interpreted as some sort of call to arms for a fight for independence (Spanish language link). Such ridiculous analysis cannot be for lack of understanding by qualified journalists so it can only be deliberate spin from those who fear).

Back to Evo; Here we go with the translated section and truly I say unto you, if you can fully understand the first sentence of the translation below you'll understand more about the continent than 99.9% of gringos. You guys get fed a line about Evo and never get to hear about how intelligent the guy really is. Maybe not that educated, but oh my the guy is smart. Here we see him railing against capitalism once again. Personally I support capitalism in its best aspect but you have to be aware of the downsides, too. The wise will listen and react to the complaints from the have-nots about the effects of the rampant and uncaring side of capitalism that we all know exists (but perhaps prefer not to visit too much). The blind will ignore them and finish as the ones complaining. Here's Evo:

"For thousands of years we lived with nature, in constant balance with her and inside her. Today we feel the devastating effects of the neoliberal, transnational capitalist system that is quickly destroying our planet.

"From outside and above, they still try to impose upon us economic policies that attack our rights as people, the rights of other living creatures and the rights of planet earth. They still try to sell us trinkets for gold. They told us there was a discovery when there was in fact an invasion. They told us there was a conquest when there was a genocide. And now they say that they want integration and to include us in the world economy when all they really want is to steal our riches, keep the profits and ignore solidarity."

Swine Flu: The South American league table updated

Meanwhile Chile, being all competitive and that, always seems to want to be top nation in everything down here. The biggest move has been made by Argentina which has shot up to 80 cases in quicktime. Between them Chile and Argentina have managed to hog 2/3rds of confirmed cases down here. Notable has been the lack of progress made by Colombia, as it registered some of the first cases in the region; they must be doing something right, methinks.

Another factor is, of course, the weather. Draw a line through the continent at Quito and anything below is now approaching winter (late June/early July is the coldest moment), but more importantly if you draw a line just below the top of Argentina that kind of cuts Paraguay in half and finishes at Sao Paolo, Brazil, anything below is out of the tropics zone and has cold winter weather in the same way that you guys up there experience from November to February. Also, areas of higher altitude countries such as Bolivia, Peru and Ecuador will always be more prone to these things.

So are you thinking what I'm thinking? Yep, come November the North has a problem.

Friday, May 29, 2009

The Friday OT: Korn, Word Up

And a great video too. Play it loud.

The IKN mining caption competition: THE RESULTS

With thirty-two players (some of whom entering multiple captions too) apologies in advance if you don't make the finals page. The standard was high all round but I had to cut it down to a finalists roster otherwise this post would get way long and silly. So I've chosen seven captions as mighty flighty finalists, and winners you all are. We'll go in reverse order. Points were awarded for 1) making me laugh (the most important criteria) 2) shining wit 3) knowledge of mining 4) knowledge of Venezuela. Click on any of the entries to make them bigger.

On with the show!

Trading Post (it's a wrap edition)

Rusoro (RML.v) up 3.2% at $0.49, not the biggest move out there by any means but as the company reports its 1q09 earnings today it's highly significant. Looks like PI Financial Corp has lifted its foot....all aboard!

Capella Resources (KPS.v) down 7.5% at $0.37 and wonderful to see the market recognizing a scam when it sees one. I feel like breaking into 'the extremely rude Frenchman' from the Holy Grail right now.

AuEx Ventures (XAU.to) up 11.3% at $2.85 and as one IM partner will testify I was that close to picking some up today at $2.5 or so but decided not to as today isn't my idea of a buying day. Never mind, no greed here and it's been a great week at the markets.

Watch out later for the results of the caption competition and The IKN Weekly is already shaping up well for Sunday.

Minera Andes (MAI.to)

As for the short-term (i.e. today), my only commentary is "WHEEEEEEEEEEE!!!!"

As for the short-term (i.e. today), my only commentary is "WHEEEEEEEEEEE!!!!"

Silver juniors, a year-to-date chart

And what's that one at the bottom? Oh yeah, it's ECU.to. Woof woof.

The IKN Weekly making a difference

As for this weekend's edition, here's a list of some (not all) of the fun on offer in IKN5:

- An exclusive interview with the CEO of one of our preferred stocks

- An examination of the "all boats rise" phenomenon that we're seeing right now and how to navigate the bullish sector feeling over the longer term

- An updated NOBS report on my top pick for the year, Troy Resources (TRY.to)

- A headsup on an interesting mining play flying under virtually all radars

As well as all the usual notes and comments on political and company happenings to mark subscribers' cards for the future. So if you haven't signed up yet, hopefully this post might tempt you to risk 25 bucks and find out for yourself. All new subscribers also get issue one as a freebie, as it gives background on the objectives for the service and a starting point to see how we've been getting on with the picks (well in the green, for sure). The subs buttons are over there on the right. Have a good day, people.

Peru first quarter GDP growth +1.8%

The true number is probably somewhere between the two figures. On the one hand there is reason to credit things like internet commerce and a more active banking system in a revised method. But on the other hand, as Seminario rightly points out, "An economy that grows via the service sector is always suspicious."

That Twobreakfasts is manipulating the figures is undeniable for all expect his most ardent fans (and with a 29% approval rating there aren't many of them around). The only question is "by how much?".

Chart of the day is.......

Thursday, May 28, 2009

Tessellations Index

Click the figure below to see the Tessellations Index.

See also:

Tessellation Transformation

Tessellations Index

Tessellation Transformation

Under the Generalized Dual Method, an arrangement of lines leads to a zonogonal tessellation. What happens if most of the lines are fixed, but a subset moves? Source: Russell Towle.

Click the figure below to see the video.

See also:

Tessellation Transformation

Tessellations Index

The IKN mining caption competition

Trading Post (be there first edition)

Fortuna Silver (FVI.v) up 6.3% at $1.01. Here's a chart dedicated to Casey Research.

Radius Gold (RDU.v) up 19.3% at $0.185 on strong volumes, too. Sheepies is as sheepies does. The trick with the herd is to be one step ahead and the way to do that is find undervalued quality. RDU.v fits the bill.

Guyana Goldfields (GUY.to) up 4.4% at $4.02. Herbert Lom said it best; "Every day in every way I'm getting better and better". Let it ride, dudes...let it ride.

Ventana Gold (VEN.to) up 9.7% at $2.26 and popping again (but without the big big volumes of yesterday). Something's in the works.....UPDATE: Aaah, that's why VEN.to did volume yesterday

Problem 294: Right triangle, Circumcenter, Excenter, Hypotenuse, Perpendicular

Click the figure below to see the complete problem 294.

See also:

Complete Problem 294

Collection of Geometry Problems

Level: High School, SAT Prep, College geometry

Want the suppressed pictures of US army personnel raping women and men in Ghraib?

Press freedom in Bolivia

a) Opposition newspapers that support the ousting of a democratically elected and popular President?

b) Far right wing rabid pressure groups and sold-out bloggers based in Washington and picking up stipends from big biz for spreading lies?

c) The Inter American Press Association?

"Who they, Otto?", I here you ask. Well the IAPA is the journalists' association covering 1,300 publications and in the business of protecting free speech for its members and the wider press corps since 1943. This from the IAPA website gives more detail:

The Inter American Press Association is a non-profit organization dedicated to defending freedom of expression and of the press throughout the Americas. Its chief aims are to:

Defend press freedom wherever it is challenged in the Americas;

Protect the interests of the press in the Americas;

Advocate the dignity, rights and responsibilities of journalism;

Encourage high standards of professional and business conduct;

Foster the exchange of ideas and information that con-tribute to the professional and technical development of the press;

Foster a wider knowledge and greater interchange among the peoples of the Americas in support of the basic principles of a free society and individual liberty.

IAPA enjoys a membership in excess of 1,300,representing newspapers and magazines from Patagonia to Alaska, with a combined circulation of 43,353,762.

So there you go, now you know a lot more. Yesterday the president of the association, Enrique Santos (also a reporter at El Tiempo in Bogotá), was in Bolivia to meet with Dr. Morales and hold meetings on the subject he most cares about. Here's what he had to say on press freedom in Bolivia:

"What we have been able to ascertain is that press freedom exists in Bolivia. For all that one hears and sees, nobody here can say that there isn't an opposition press, that there is no criticism of the government. I think it's important to make this clear."Any further questions?

no link mining bits

Ventana Gold (VEN.to) suddenly did very large volumes at the end of yesterday's trading, finishing up with 2.4m shares done.

Junior miners in the Lima stock market continue to be bought like hotcakes, including big volumes in VEM, MIRL and DNT amongst others.

I did wonder about that Linear Gold (LR.to) purchase that shot the PPS up this week...I didn't look into it much (up in Canada, y'see) but it seemed so clean and shinyhappy for a property that has been around a while and never moved into prodution. So now we know that ownership is disputed...ahhhhh. LRR.to down today.

Duggie at GRZ vows to "fight on" over Brisas which will come as no surprise to anyone. Hey, here's a phun phactoid about Belanger; guess how many times he has visited Venezuela this decade? (Hint: if you guessed "1" you're overestimating).

Now that the US dollar hasn't broken 80 to the downside, will Jim Sinclair apologize to his flock about all the "it's happening now!!" shilling from last week? Ok, stupid question....

Chart of the day is....

According to this report in BNAmericas, the head honcho at the IBS Brazil steel institute says that even in the most optimistic of situations and a 5% GDP growth from 2010, steel consumption won't return to the 2008 level until 2011. The same dudes are also forecasting a 14% world slump in steel this year and a large supply glut.

According to this report in BNAmericas, the head honcho at the IBS Brazil steel institute says that even in the most optimistic of situations and a 5% GDP growth from 2010, steel consumption won't return to the 2008 level until 2011. The same dudes are also forecasting a 14% world slump in steel this year and a large supply glut.By the way, I thought about using the US bonds yield curve as chart of the day today, but you're probably bored or scared to death by it already so let's not bother.

Wednesday, May 27, 2009

You sure that Colombian coffee is from Colombia, Señor Valdez?

In a good report yesterday, Bloomie's Heather Walsh caught up with Jorge Lozano of the National Association of Colombian Coffee Exporters who predicted that, due mainly to inclement weather factors, Colombia would produce less than 11 million bags of coffee this year for the first time since 2001. For the record a "bag" weighs 60kg, so as 2008 production was 11.5m bags we're looking at a difference of 30,000 metric tonnes (hey, lotta coffee there people..world's third largest producer after Brazil and Vietnam). Lozano is quoted as saying;

“The figures we’re seeing show a substantial reduction. Eleven million would be a miracle....Colombia has been selling all of its production.”Indeed it has been selling it all. Keen to do it too, as coffee is one of the main export products of the country and is driven by the famous Juan Valdez "100% Pure Colombian Coffee" campaign as the dude and his donkey wander over the TV screens of the USA. But is it that pure? This year there's good reason to suspect that those 100% Colombian beans are currently being cut with coffee imported into Colombia from other countries.

Exhibit one: This report in Peru's El Comercio that has local coffee growers complaining about unfair competition. Apparently Peruvian coffee growers have been selling a lot of their wares to Colombians for better prices than they would have obtained by selling on the open market or via established deals and the Peru coffee people are worried about making the contracted quotas due to this selling to Colombia. El Comercio reports the words of César Rivas Peña, head of the National Coffee Group, in the following way:

Mysteriously, so far this year 132,000 quintales of coffee have been sent to Colombia when normally only 80,000 are sent.As a Peruvian "quintal" is a measurement of 46kg, this means that so far this year 6,072MT of Peruvian coffee beans have made their way into Colombia, or in other words 1/5th of Colombia's theoretical YoY shortfall.

Exhibit Two: Your humble servant wondered whether Colombia's stats office, DANE, was also registering higher coffee imports this year. So off I trotted to the DANE site and got to the right page (if you really care and are as wonky as me you need to click "annexos estadísticos 2009 (Marzo)" to get the right XLS file to pop up and then it's the line item 24 on the Excel page A11) and sure enough, the diligent people at DANE had registered an increase in coffee imports in the first three months of 2009.

An enormous, eye-popping 405% increase, in fact (yes, that says four hundred and five percent). Imports of "coffees, teas and infusions" (read 'coffee') have risen from 1,412MT in the first quarter of 2008 to 7,134MT in the first quarter of 2009, a difference of 5,722MT. It also means that if Colombia keeps importing at the same rate throughout 2009 it will end up buying around 28,500MT of foreign coffee...which is weirdly and strangely close to the 30,000MT production shortfall predicted by Jorge Lozano in his interview with Heather Walsh. On another level, by cutting that down into monthly averages it means we can estimate 2/3rds of the coffee imports have so far come from Peru. It remains to be seen whether Peru will keep supplying Colombia at such and accelerated rhythm, however, if its own export association is starting to cry foul.

Exhibit three: And here's the strangest thing. While Jorge Lozano, a 79 year old past master expert of his field, was telling Bloomie that 11m bags in 2009 would be "a miracle", the Colombian minister in charge of the coffee sector was making soothing and smoothing noises to the world in London today. Colombian Agriculture Minister Andres Fernandez Acosta was quoted by Reuters as saying:

"We have no defaults at the moment and we won't have defaults. Because of weather conditions there have been delays. By June everything will be in place and we will have no problems meeting our commitments."

He then went on to say that Colombia's 2009 production would be 11.5m bags, a full half a million bags (and again, that coincidental 30,000MT) greater than Lozano's "miracle limit" of 11M bags.

Conclusion: It looks to me as if Colombia isn't going to live up to its advertised "100% Colombian" claims this year. That a political talking head can predict a substantially higher harvest of coffee than someone who knows the industry backwards and has worked in it all their life is one reason to be very suspicious. That Peruvian coffee producers are complaining of unfair competition from Colombian buyers who are snapping up their coffee (and not any old bean either, as Peru complains that Colombia only wants its top "export quality" product). And the sudden 400% increase in coffee imports registered by the Colombian stats office gives the issue a numerical backbone, too. With all the numbers (the shortfall, the imports, the ministerial overestimation) all hovering around the 30,000MT mark the coincidences become too much to ignore.

So next time you enjoy a cup of Valdez's "100% pure Colombian" finest, don't fret too much if you start having visions of the Nazca lines or Machu Picchu.

Ain't no joking with the press for a lefty

That started the whole world crying

But I didn't see

That the joke was on me

I Started a Joke, The Bee Gees, 1968

In a relaxed atmosphere, Chávez joked with Lula by saying that Venezuela was going through a phase of "nationalizations, except for Brazilian companies (in Venezuela)" which caused generalized laughter at the meeting.

However,

- Argentine press were also present.

- Argentine press that don't like Chávez

- And Argentina is just 31 days away from the polls in its hotly contested senate elections

Yep, the anti-Kirchner bizmedia and MSM in Buenos Aires who had watched Chávez recently nationalize the Techint-owned steel mill in Venezuela (and pay a suitable price for the asset, it must be pointed out) opened up with all barrels blazing on Chávez and the way that this dictator friend of the Kirchners was about to take over every Argentine asset in Venezuela and how, of course, Klishtina would start down the same path as soon as the key elections next month were over.....if Argentina lets her.

Once it got to the point of the Argentine industrial union (the biz bigwigs association there) calling for a bar on Venezuela as a Mercosur partner, Klishtina got on the phone to Chávez and asked him about his comments that seem to "involve certain discrimination". It was only at that point that Hugo realized what he'd done (i.e. had the temerity to crack a joke and treat those present as adults...big mistake when it comes to reporters in South America) and so this afternooon he got his diplo corps to issue a formal communicado that officially tells in official language just how much Venezuela respects Argentina and they'd never do anything to piss them off and it was all a smear campaign by certain sectors of the press etc etc read it here if you like...letterheaded paper and everything.

Moral of the story: Don't crack jokes in the presence of dumbasses with recording equipment, teeline skills and editors with agendas.

Parallel Lines Index

Click the figure below to see Parallel lines: Theorems and Problems Index.

See also:

Parallel lines, Theorems and Problems Index

Geometry Index

Level: High School, SAT Prep, College geometry

Trading Post (Messi edition)

Candente (DNT.to) up 15% at C$0.42 and also doing great business on the Lima exchange. The time is nigh for the spinoff.

Vena Resources (VEM.to) down a penny at $0.32 in Canada but also going great guns in Lima with 168,000 shares traded. When this thing suddenly pops 20% or 30% I'll be the one with the smartalec grin on his face going "toldya so toldya so".

Guyana Gold up 1.5% at $3.85 and the beat goes on. This thing has been unstoppable in the last couple of weeks. Templeton happy. Sprott happy. Otto happy.

Rocmec (RMI.v) up 14.3% at 8c. I've mentioned this microdot stock on the blog a few times and it's still on my radar. It's been bouncing around in the 7c to 9c range in the last few weeks but I note some interesting insider buying activity recently, with headhoncho Brisebois buying into the company's own financing placement to the tune of 100,000 units. Not the worst place for some über-risk capital that's for sure, but I couldn't personally get comfy and buy until I know more about this thermal fragmentation technology thingy. It's intruiging and if they ever give me the chance I'd like to check it out in situ. Waddya say, Stella?

UPDATE: Half-time, Barcelona 1, Man Utd 0 and things going well so far. Here's a great shot of Messi in full flow during the first half.

UPDATE 2: And this is Messi about two seconds after scoring Barsa's second (a header!). It's all over, 2-0 Messi whups world and the footballing gods smile upon us.

UPDATE 2: And this is Messi about two seconds after scoring Barsa's second (a header!). It's all over, 2-0 Messi whups world and the footballing gods smile upon us.

Paraguay update

"We have been ignored by him (Lugo) and he has to understand that the time of the single leader is over. A person of this immoral calibre cannot be spoken to....He doesn't accept the agenda of others but makes others accept his. He has to understand the (dictator and Ex President Alfredo) Stroessner is dead, that this man should understand that this is no longer inside democracy."

So by way of a bit of background to Oviedo's declarations today, let's try and give you a bit of equal context about Oviedo calling Lugo "immoral and indignant".

Example one: Madonna is scandalized by the fact that Britney Spears isn't a virgin.

Example two: Barry Bonds horrified by stories that track&field athletes take performance enhancing drugs.

Example three: Dick Cheney shocked about the way The Hawaiian might fudge an issue or two about foreign policy.

I could go on, but you should have the picture by now.

Venezuelan finances on my mind

Really, it does. As well as being a solid argument, it is also rigorously academic (but fortunately also readable by the layman). It looks into the recent history of oil production reporting in Venezuela and shows exactly how the foreign secondary bodies deliberately underestimate Venezuela's oil production numbers. It also suggests a couple of reasons as to why...interesting stuff.

At the end of the show, Boué nails down the last five months of numbers and shows that, once internal demand figures are factored in, Venezuela's oil production is running at around 3.1m barrels per day. This is just where PDVSA says it is and importantly it's demonstrated without relying on company figures because detractors and know-nothings are always quick to shout 'propaganda' at PDVSA's reported numbers. Three-point-one-million is, of course, a mile away from the 2.35m barrels that is quoted by English speaking media and gleaned from bodies such as the IEA that are shown by Boué to use simple statistical manipulation in their underestimations. However it's always the lower IEA figures that are picked up by the rabid Anti-Chávez brigade as they wail how PDVSA is going to hell in a handbasket (amazingly, the same song is sung every year....every year they're proved wrong and every year they say "yeah, but you wait til next year!"). Strange that, innit?

It got me thinking about the importance of oil to Venezuela, too. To put into context (for the miningheads that read this page anyway), try this: Consider all the gold that's underground in the Bolivar state region of Venezuela, including all the gold underground at Las Cristinas, Brisas, the Chocos and all the other concessions parcelled off and owned by Rusoro and all the other smaller players down there. Now dig up all that gold, process it and sell it all at once. The revenues from that gold would be the revenues from six months or so of Venezuelan oil production, and at current rates of extraction there's enough oil to last for the next 200 years.

Anyway, go read Boué's most excellent English language note about Venezuela's oil production. It really is the recommended link of the week, superbly educational and wise. Here's the link again, just in case.

They call it (in)elasticity

This report from AP covered the news from the USA's National Association of Realtors that home sales rose 2.9% in April and is full of positive spin, using phrases such as "snap up bargains", "rose modestly", "beat expectations", "buyers swooped in" etc etc.

But you can't hide economics 101 from the figures, either. When annual sales rise 2.9% to 468,000 and average house prices drop by 15.4% in the same period, you just know there are lower prices to come. This isn't even worth debating...you can, quite literally, put the mortgage on it.

Icebergs ahoy!

PI Financial Corp has still got its foot firmly on the Rusoro PPS, but this morning's action looks like melting a large chunk of the iceberg that's suppressed the stock. Here's today's early morning action and "59" is still squatting on that ask.

DYODD, dudes, as Venezuela exposed gold stocks aren't for the faint of heart.