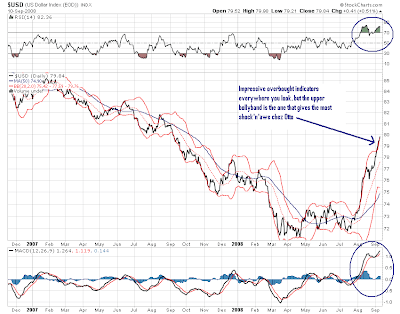

I'm glad Gary BiiWii turned his attention to the USD this morning and posted this chart.....

.....on his public blog, cos it means I can swipe it, put it up here, link to him and get a better class of chart on the subject here with little sweat. The other forex matter that has torn me away from LatAm this morning is the state of the British Pound (GBP) in the wake of the UK General Election, the hung parliament and the serious, highest-level-possible horse trading that's going on right now.

That downspike to under 1.45/1 happened when Gordon Brown reached out to the now kingmaker Nick Clegg and offered him "far reaching reforms" (i.e. proportional representation is now on the table) if he'd come play alliances and let him keep his job. Meanwhile the Conservatives are pretty close themselves and might even manage to form a minority government. What the market wants, more than one-or-the-other-side winning out, is a quick resolution to the horse trading. That might be more complicated than it sounds and hence the drop in the GBP. Certainly the funnest currency to play in the next few days.

That downspike to under 1.45/1 happened when Gordon Brown reached out to the now kingmaker Nick Clegg and offered him "far reaching reforms" (i.e. proportional representation is now on the table) if he'd come play alliances and let him keep his job. Meanwhile the Conservatives are pretty close themselves and might even manage to form a minority government. What the market wants, more than one-or-the-other-side winning out, is a quick resolution to the horse trading. That might be more complicated than it sounds and hence the drop in the GBP. Certainly the funnest currency to play in the next few days.

Add in the FunkyMonk rollercoaster ride at the NYSE and it's one helluva day to be tuned into the markets....especially when you never work on margin :-)

.....on his public blog, cos it means I can swipe it, put it up here, link to him and get a better class of chart on the subject here with little sweat. The other forex matter that has torn me away from LatAm this morning is the state of the British Pound (GBP) in the wake of the UK General Election, the hung parliament and the serious, highest-level-possible horse trading that's going on right now.

That downspike to under 1.45/1 happened when Gordon Brown reached out to the now kingmaker Nick Clegg and offered him "far reaching reforms" (i.e. proportional representation is now on the table) if he'd come play alliances and let him keep his job. Meanwhile the Conservatives are pretty close themselves and might even manage to form a minority government. What the market wants, more than one-or-the-other-side winning out, is a quick resolution to the horse trading. That might be more complicated than it sounds and hence the drop in the GBP. Certainly the funnest currency to play in the next few days.

That downspike to under 1.45/1 happened when Gordon Brown reached out to the now kingmaker Nick Clegg and offered him "far reaching reforms" (i.e. proportional representation is now on the table) if he'd come play alliances and let him keep his job. Meanwhile the Conservatives are pretty close themselves and might even manage to form a minority government. What the market wants, more than one-or-the-other-side winning out, is a quick resolution to the horse trading. That might be more complicated than it sounds and hence the drop in the GBP. Certainly the funnest currency to play in the next few days.Add in the FunkyMonk rollercoaster ride at the NYSE and it's one helluva day to be tuned into the markets....especially when you never work on margin :-)