16 September 2011

Sunday, October 2, 2011

Monday, September 26, 2011

Bookstaber on learning from the industrial revolution

We interrupt this temporarily quietened blog to bring you an top link. Click right here and read "What can we learn from the policies that spurred the Industrial Revolution?" at Rick Bookstaber's place. If you read just one thing on the internet this week, make it this article. Most excellent brainfood.

Sunday, September 25, 2011

On the road

Your author is pretending to work while travelling around a bit for the next four days. Posting will be light this week. Here's Jack.

"Why think about that when all the golden land's ahead of you and all kinds of unforeseen events wait lurking to surprise you and make you glad you're alive to see?"

Labels:

jack kerouac

Saturday, September 24, 2011

The two most popular IKN posts of the last week...

...were this one that contained KCs wonderful chart, shown again here:

"This is a deceptively simple philosophy that I have been working on and fine tuning for most of my life. I am delighted to say that I believe I have refined it down to its essence- - sufficiently to share it with a select band of friends that may appreciate its elegance and simplicity."

Then this one, featuring Brent Cook and Mickey Fulp getting interviewed by the Kitco girl at a bar, JDs on ice at hand. Again shown right here.

Faster than light neutrinos

So let's see...

UPDATE: When hitting the publish button on this guff'n'nonsense, I wondered how long it would be before someone took the bait. Didn't take long.... By the way, the 5th rule of the internet is that irony doesn't travel.

UPDATE 2: Oh, just in case you haven't heard it yet here's the neutrino joke:

1) Scientists confirm that neutrinos do indeed travel faster than light

2) They then find a way of controlling a flow of neutrinos.

3) This controlled flow is then used to design a messaging system (it can be pretty simple, e.g. one burst of neutrinos is a 1, a double burst is a zero, binary computer systems take it from there)

4) As soon as the messaging system is understood it's used by somebody in, let's say, 2025, to send a message back to the person who invented the neutrino-control-and-messaging service on, let's say, May 23rd 2012.

5) The message sent back in time alerts us to a pending catastrophic event in, let's say, 2018 and how to avoid it.

6) We in 2012 take the necessary measures to avoid the event, thus it never happens.

7) This then negates the need for the message sent in the year 2025 to the year 2012.

8) Which means the message is never sent.

9) Which means the catastrophe is not avoided and it happens.

10) Wait a minute.....

UPDATE: When hitting the publish button on this guff'n'nonsense, I wondered how long it would be before someone took the bait. Didn't take long.... By the way, the 5th rule of the internet is that irony doesn't travel.

UPDATE 2: Oh, just in case you haven't heard it yet here's the neutrino joke:

The barman says, "Sorry mate, we don't serve neutrinos in here."

A neutrino walks into a bar.

Gold (GLD) vs Silver (SLV) vs Gold Miners (GDX) vs Juniors (GDXJ), ten day chart

We've featured this comparative chart a few times in the last week, basically to keep an eye on how the miners have been doing compared to the metals.

Today we update, basically to scare the bejeez out of you.

That is nasty.

Today we update, basically to scare the bejeez out of you.

That is nasty.

Friday, September 23, 2011

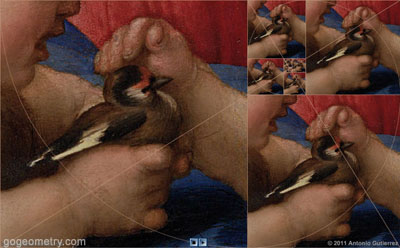

Problem 673: Internally tangent circles, Chord, Tangent, Metric Relations

Geometry Problem

Level: Mathematics Education, High School, Honors Geometry, College.

Click the figure below to see the complete problem 673.

Level: Mathematics Education, High School, Honors Geometry, College.

Click the figure below to see the complete problem 673.

Labels:

chord,

circle,

metric relations,

tangent

The Friday OT: Don Henley; The boys of summer

This is not one of any number of cover versions, this is the original song. This is the one that had me playing it over and over way back when pals of mine were into the music I was supposed to like. It's also an oblique tribute to gold today, as Gary and those who follow his wonderful blog will get the "...will be strong after the boys of summer have gone" reference, I'm quite sure.

Don't look back, you can never look back

Problem 672: Internally tangent circles, Chord, Tangent, Geometric Mean

Geometry Problem

Level: Mathematics Education, High School, Honors Geometry, College.

Click the figure below to see the complete problem 672.

Level: Mathematics Education, High School, Honors Geometry, College.

Click the figure below to see the complete problem 672.

Labels:

chord,

circle,

geometric mean,

metric relations,

tangent

Setty uncovers a LatAm oil & gas fraud

Not just iffy and doubtful practices...nah Setty doesn't mess about and just goes straight for the 100% outright criminal fraud scam operations...ones such as Arevenca

Read all about it here, because it's one helluva good post.

Thursday, September 22, 2011

Four burning questions on today's market action (with two answers)

1) Who is Eric Sprott going to blame for silver's drop this time? The Martians?

2) Which of your equities positions will go green first? I know which one looks most likely in my port and I'm guessing it turns away from the dark side about 1pm EST.

3) How do you confuse an Austrian? (Answer: Ask him why the dollar has been strong recently)

4) What's the best video to sum up this morning? (Answer below)

By the way, subbers; Re this morning's flash update already bot a few, but more to go. Still careful fishin'

UPDATE: FWIW, the suspected bouncer was a double figure loser this morning, but even though it's now only 1% down it didn't make it into the green....so a fail is a fail.

Problem 671: Triangle, Cevian, Angles, Congruence

Geometry Problem

Level: Mathematics Education, High School, Honors Geometry, College.

Click the figure below to see the complete problem 671.

Level: Mathematics Education, High School, Honors Geometry, College.

Click the figure below to see the complete problem 671.

Labels:

angle,

cevian,

congruence,

triangle

OT: Today's handy twitter tip

Top tip! If you secretly employ ghost writers who pretend to be you on Twitter and you then fire one of them, ALWAYS REMEMBER TO CHANGE YOUR PASSWORD. This from the twitter a/c of some zero called @markdavidson today:

Totally pwned!

HudBay Minerals (HBM) (HBM.to): Touchy feely community relations sure beats hacking 'em to death with machetes

Me? I get all confused about these things. After all what with Hudbay (HBM.to) (HBM) now building its Constancia mine in southern Peru, it's only right that the company reaches out to locals. For example the $10,000 it just donated to a local university to sponsor "The Hudbay Classroom" that'll teach all things mining to keen minds. As part of the promo blurb, the company told us (translated):

"This agreement is part of our framework of responsibility and social inclusion, whose objective is always to provide to the communities where HudBay operates."

Which does compare favourably to the way it used to do business in other LatAm countries. For example at its Fenix project in Guatemala two years ago:

"Just over a year ago, my husband, Adolfo Ich Chamán, was killed by security forces employed at the Fenix mining project in Guatemala – a mining project owned by Canadian company HudBay Minerals. In the afternoon of September 27, 2009, I watched my husband leave our house for the last time. I later learned that mine security forces had surrounded my husband, dragged him through a gap in a fence and hacked at him with machetes. Then the mine’s chief of security shot him in the neck at close range. This attack was unprovoked."

The good news is that since that event, when HudBay employees murdered an anti-mining activist at its mine project in Guatemala, HudBay sold the project to another firm. So that doesn't count any more, right?

Two silver charts

The first one dedicated to those who prefer getting their market news, views and opinions from Zerohedge:

The second one for the rest of you people who prefer to make profits in the markets:

Today's handy stock market hint: It really is easier to make money when you're not an asshole. DYODD

The second one for the rest of you people who prefer to make profits in the markets:

Today's handy stock market hint: It really is easier to make money when you're not an asshole. DYODD

Chart of the day is...

...received from reader 'KC' and comes with the following:

"This is a deceptively simple philosophy that I have been working on and fine tuning for most of my life. I am delighted to say that I believe I have refined it down to its essence- - sufficiently to share it with a select band of friends that may appreciate its elegance and simplicity."

Labels:

chart

Wednesday, September 21, 2011

Dudes! A metalheads must-watch

A girl, two boys and a bottle of JD.

Fun fun stuff, enjoy.

UPDATE: Long-time mail exchanger, rockbrain and cyberpal, reader 'MP' writes in with:

Fun fun stuff, enjoy.

UPDATE: Long-time mail exchanger, rockbrain and cyberpal, reader 'MP' writes in with:

"Whoa! Nice stopes!"

1) A general macro thinkpiece from IKN124, 2) a stock chart 3) an owl

1) Here's the piece that was featured in IKN124, published to subscribers last Sunday September 18th, that talked about the opportunity afforded by beaten down plays with Peru exposure:

Peru’s IGBVL ‘General’ index offers clues to value in PeruThis is a stock market index I watch closely and it’s been mentioned on these pages on plenty of previous occasions. The reason why it’s got my eye is that it combines strong mining presence (Peru being Peru, about 65% of the total index weighting is directly from mining companies) with the volatility of an Emerging Market with good growth, thanks to a country that, macro-economically speaking at least, is running its shop well. It also happens to list several companies that your author follows closely or even owns, but that’s a secondary reason really because all access to those stocks is just as easy via the Canadian, US or London markets.

So to the squiggly lines and the reason for featuring the IGBVL index today. We see that by comparing the Peru index to the S&P500 year-to-date there have been two major periods worthy of mention. The first started around April and finished around mid-July, when Peru’s first possible then confirmed election of Ollanta Humala as its new President spooked the markets and caused some strong volatility. Then the more recent period, from around mid-July to today, is far more interesting in the considered opinion of your author not least because it’s where we find ourselves today. Now we have an IGBVL that’s moving very much in lockstep with the wider world (represented by the S&P500 index) that, in turn, suggests that the market is more relaxed about the way things are in Peru politically.That’s as it should be, because the fears that many had about Peru’s new mandatory (including those of your author before Humala’s impressive move to the centre post round one voting) have not been realized and it’s becoming clear that business is welcomed and encouraged, as it's a stable playing field for those wanting to invest.So the expected process of “hey, Peru isn’t so bad after all” has begun, with the first stage that of a market index that has stopped falling and is acting like the rest of the world. This is good, but it also means that there are still Peru-exposed issues that were beaten down due to the ill-perceived political risk and haven’t yet recovered. Your author has his bought-in positions in some of these and this type of bigger-picture strategy note isn’t the place to start touting stocks. We’re all big girls and boys here, DYODD but at least recognize that the consolidation of the Peru macro picture may now be offering decent gains in stocks that haven’t played their catch-up yet.

2) Here's the five day chart of Bear Creek Mining (BCM.v)

3) Here's an owl:

DYODD, dude.

Disclosure: Long BCM.v, entry price $3.80. And the target on the trade is plenty above today's price so not selling yet, either. And while I'm here, I'd just like to thank that dumbass Lobito for the opportunities he offers the rest of us...keep em coming, dude!

Labels:

BCM.v,

bear creek,

Peru,

political risk

Hathor (HAT.to) CEO Mike Gunning on BNN

When this six minute TV interview started yesterday morning, Hathor (HAT.to) traded at $4.06. When it was done, HAT.to went to (and closed the day at) $4.18. Click here and watch it yourself.

Gold (GLD) versus the gold miners (GDX) redux

After yesterday's post, here's the same chart updated to include yesterday's action:

We kinda mentioned this might happen, no? Just sayin'...

Anyway, your humble scribe's wild'n'whacky adventures at the tooth doctor continue today, so posts may again be on the light side.

Chart of the day is...

...the long-term price of diamonds:

Because I had the weirdest dream about this last night. Chart from this page

50 Years Historical diamond price trend chart

for average One Carat D Loupe Clean wholesale diamond prices

for average One Carat D Loupe Clean wholesale diamond prices

Evolution Graph from 1960 to 2010

Because I had the weirdest dream about this last night. Chart from this page

UPDATE: Via his twitter a/c, @randyduax points your humble scribe towards this diamond robbery story. Utterly fascinating, thanks RD.

Labels:

chart

Tuesday, September 20, 2011

Mailbag

Question of the day comes from reader 'FT' with:

Answer:

"...what's your number one Red Hot Chili Peppers song?"

Of all the weird psychological phenomena in the stock market...

...one of the most common that never ceases to amuse your humble scribe is how a stock has to go up by 50% or so before a whole bunch of people realize that it's damned cheap at the new, higher price.

DYODD dudette, DYODD dude.

Labels:

rio alto mining,

rio.v

Gold (GLD) versus the gold miners (GDX)

Oh looky, something's changing all right:

The new element in the picture is called "logic". It eventually prevails.

In other news, your humble scribe would like to mention to his esteemed audience that over the next two mornings he will be looking up the nose of a orthodontist during a couple of 2 1/2 hour sessions of dental fun'n'frolics. In other words, light posting days are here. Please be having you yes the day that is nice yes thank you.

Chart of the day is...

...a poll of three polls taken in September 2011 that show voter intention for the 2011 Argentina Presidential elections, set to take place on October 23rd:

Just so you know, a winner will be declared in round one if either a) any single candidate gets more than 45% of the vote or b) gets more than 40% with the second placed candidate more than 10% behind.

Or put more simply, what part of "Cristina wins" do you not understand?

H/T Ricardo at los huevos y las ideas

Monday, September 19, 2011

OT: A NASA photograph

Beauty is an ecstasy; it is as simple as hunger. There is really nothing to be said about it

Somerset Maugham, 'Cakes and Ale', 1930

NASA's Cassini spacecraft took this photo of five of Saturn's moons along with the planet's rings on July 29th 2011. Find out more right here.

(click to enlarge)

A photo that leaves your humble scribe speechless on many levels. Dedicated to Setty on his birthday.

Members can access more photos at our Linkedin group

Members can access more photos at our Linkedin group

| From SOMP 2011 in Peru |

Members can access more photos at our Linkedin group

| From PERUMIN 2011, Peru, Arequipa |

Argentina: A little heterodoxy goes a long way

A good paper by Robert L Funk and Francisco Javier Diaz came out late last week, all about Argentina and its relevance to the present-day Greek tragedy (geddit?). It starts like this and your author urges you to click through and read it all, because its argument is more insightful than the usual tosh written about the country.

Argentina: A little heterodoxy goes a long way

A tough, pragmatic mindset has seen an unorthodox Argentine economy move from Greek-style tragedy to relative stability

For most of the last hundred years, those who study the comparative politics of Latin America have been struggling to pigeonhole Argentina, and especially Peronism, into one category or another. They do so at their peril. It is worth recalling that Simon Kuznets, an economist, once quipped that countries could be grouped into four: developed, underdeveloped, Japan and Argentina. Today under President Cristina Fernández the country continues to defy explanation.

Taipan Publishing pumps Fortuna Silver (FVI.to) (FSM)

Right here.

To be honest, the prose style is all gushing and pumpy and oh-my-gawd-you-gotta-get-on and really not your author's cuppa cha, but the information supplied by the report is pretty solid and factual, so there no real beef from this corner. Anyway, go read it yourself.

Labels:

fortuna silver

Néstor Valqui Matos, surely set to be Peru's rising star member of congress

We at IKN Nerve Centre™ believe that the new congressman Néstor Valqui Matos (Fuerza 2011, the Fujimori party) is destined for greatness in the newly formed congress of Peru. This is because he has the best possible training for Peru's congress already under his belt, that of being the owner of an illegal and clandestine whorehouse. Here's a translation of this report out today in Peru's El Comercio that tells you what's what:

Member of Congress for Fuerza 2011 Is The Owner Of a Whorehouse in Pasco

Néstor Valqui Matos, who has already been found guilty of pimping, says that the business no longer belongs to him.

Fabiola Torre López: Investigation Unit, El Comercio

The night of August 2, the nightlife in the mining district of Yanacancha in Pasco was busier than usual, though this time the ruckus didn't come from the discos and bars that have multiplied in the zone but from around 200 residents who had taken to the streets to declare war on the businesses that, behind the pretense of being normal places for relaxation, were dedicated to the sexual exploitation of women, some of them under-aged.

Two weeks have gone by since then, but the residents' marches and operations by the municipal fiscal have not managed to stop these businesses, amongst them the 'Night Club Discotek Calusa', the biggest nightclub in Yanacancha. Its owner, according to the respective documentation, are no less people than the congress member Néstor Valqui Matos (Fuerza 2011) and his wife Edy Estrada Atencio.

The nightclub is a four storey building located on the road Ángel Ramos Picón, number 311. Since 2001 it has had a licence to function as a discotheque, but in fact it is a location that sexually exploits young women brought from the cities of Huánuco, Ucayali and Junín. The building is constructed to promote, facilitate and cover up this activity: On the third and fourth floors there is a hostal that connects directly to the disco.

A team from this newspaper (El Comercio) recorded on video and in photographs the proofs that in this disco a clandestine centre of sexual commerce was operating.

The parliamentarian Néstor Valqui has tried to hide this business, as well as his own sentence for the crime of pimping handed down in 2008 which does not appear on his sworn resumé presented the electoral authorities when he ran for congress. Continues here.

IKN back. There's more to the story so click through, but it's worth mentioning that just that last part, the fact that he didn't include a judicial sentence as part of his CV, is a crime in Peru and enough to get this guy kicked out of congress.

Welcome to the new Peru, just the same as the old Peru.

Making the Grayd (GYD.v)

I looked at it a few months ago and passed, then didn't look again. Clearly a mistake because it seems Agnico Eagle (AEM) was looking at it around the same time...and AEM didn't pass.

Press Release Source: Grayd Resource Corporation and Agnico-Eagle Mines Limited On Monday September 19, 2011, 6:00 am EDTTORONTO, ONTARIO--(Marketwire -09/19/11)- (All amounts expressed in Canadian dollars unless otherwise noted)

Agnico-Eagle Mines Limited ("Agnico-Eagle") (NYSE: AEM - News)(TSX: AEM - News) and Grayd Resource Corporation ("Grayd") (TSX-V: GYD.V - News)(OTCQX: GYDRF.PK - News) jointly announce that they have entered into an acquisition agreement, pursuant to which Agnico-Eagle has agreed to offer to acquire all of the outstanding common shares of Grayd at $2.80 per share by way of a take-over bid. The transaction is valued at approximately $275 million on a fully-diluted basis. The offer price of $2.80 per Grayd share represents a premium of 65.7% to the volume weighted average price of Grayd shares on the TSX Venture Exchange for the 20-day period ended September 16, 2011 (the last trading day prior to announcement of the transaction).

Grayd shareholders will be entitled to receive, at their option, for each Grayd share they own either $2.80 in cash or 0.04039 of an Agnico-Eagle share and $0.05 in cash, in each case subject to pro ration. The maximum amount of cash payable by Agnico-Eagle under the offer will be equal to one third of the total consideration (approximately $92 million). The maximum number of shares issuable by Agnico-Eagle under the offer will be approximately 2.7 million (based on the number of Grayd shares outstanding on September 19, 2011 on a fully-diluted basis), or approximately 1.4% of Agnico-Eagle's outstanding shares on a fully diluted basis.CONTINUES HERE

Good job the news wasn't leaked to the chosen few on Friday, eh?

Congrats due to GYD.v and all longs on the stock, but the fun part of all of us here is the precedent AEM has just set. A major has just bought a bulk mining gold property in Mexico (other decent exploration assets on top of that) with just 1.26m oz gold under 43-101 compliance. I look at my juniors portfolio and I like that a lot.

Chart of the day is...

...copper, 60 minute chart.

To quote Alex Ferguson, it's squeaky bum time.

Or to quote a pirate, aaaaaaaaaaaaaarghhhhhhh

To quote Alex Ferguson, it's squeaky bum time.

Or to quote a pirate, aaaaaaaaaaaaaarghhhhhhh

Labels:

chart

Sunday, September 18, 2011

The IKN Weekly, out now

IKN124 has just been sent to subscribers. It contains opinions on stocks, tables, charts, links and a total of 14,432 words spread over 30 pages.

Mostly spelled correctly.

Oh dear, I never tire of that joke.

Labels:

otto,

the IKN weekly

Madonna of the Goldfinch by Raphael and Golden Rectangles

Red Hot Chili Peppers: Police Station

- I miss John's guitar, saying that out loud. Josh is very good and the RHCPs will live on happily while he's on lead guitar, but I miss John.

- As is the tendency in quality albums, it takes more than one listen to get what's going on.

- This track ranks with the very best of the band's music. Sublime.

Saturday, September 17, 2011

#Geometry Problem 670: Triangle, 60 Degrees, Orthocenter, Incenter, Circumcenter, Congruence

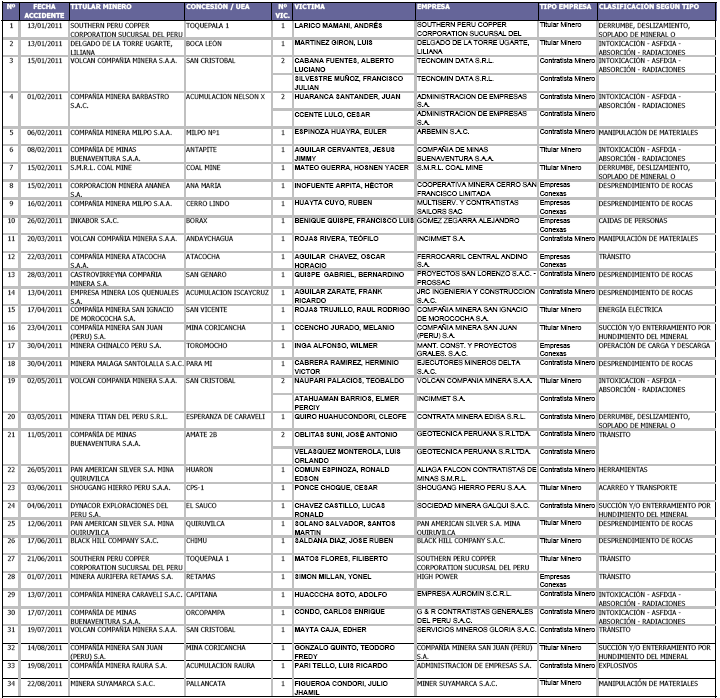

"I feel like I'm dying from mining for gold"

The wonderful Ten Percent put up this video on his blog last night to pay tribute to the four dead coal miners from Swansea, Wales, who died in an underground accident this week.

Your humble scribe picks it up, runs with it and highlights the Peru MEM page with the 38 names of those who have died in mining accidents in Peru so far this year:

Add these people to the roll call of the 66 dead in 2010, the 56 dead in 2009, the 64 dead in 2008, the 62 dead in 2007, the 65 dead in 2006, the 69 dead in 2005...and we could continue.

There's no moral to this story, just a request for readership perspective, as anyone who can afford the machine they're using to read a blog like this isn't doing all that badly. And the song is just beautiful, too.

Ritholtz: There Are No Rogue Traders, Only Rogue Banks

Barry Ritholtz is smart enough to be able to explain his complex sector of business in a plain-speaking way that the layperson can easily grasp. That takes talent and here's a great example today: In the light of the UBS rogue trader (kept it under wraps for three years!!??!!??...that's a big WTF in itself), Ritholtz pens "There Are No Rogue Traders, Only Rogue Banks" and you'd do well to read.

Friday, September 16, 2011

The Friday OT: Velvet Revolver; Fall to pieces

Slash plays the guitar, we rock out.

Velvet Revolver's best track, as requested by reader and main man SG.

Velvet Revolver's best track, as requested by reader and main man SG.

Fortuna Silver (FVI.to) (FSM), a link and an owl

Here's the link to yesterday's post on FVI, before the bell, that noted the positives that'll come from the US listing (starts Monday).

Here's the chart since then:

Here's an owl

But hey, maybe 7.7% up in a day and a half isn't your idea of a good trade. DYODD, dude.

UPDATE: I'm sorry, did I say 7.7% up....?

Labels:

fortuna silver,

fvi.to

Iron Creek Capital (IRN.v): Interesting

By way of disclosure, I own a few of these in a long term timeframe and I'm not about to sell them on any short-term pop, either. The company is in Chile looking for elephants in elephant country and it's the kind of play you need to give its due time. Explorers shall explore, don't bug them while they're concentrating hard.

Anyway, here's the interesting thing:

Iron Creek Capital Corp. (IRN) | As of September 15th, 2011 | ||||||

| Filing Date | Transaction Date | Insider Name | Ownership Type | Securities | Nature of transaction | # or value acquired or disposed of | Unit Price |

| Sep 15/11 | Sep 14/11 | Beale, Timothy J. | Direct Ownership | Common Shares | 10 - Acquisition in the public market | 180,000 | $0.480 |

I've spoken to this Beale dude too and he's smart. Something cooking?

Update: Reader RL is smarter than your humble scribe and sends this in:

Hello Otto,I think the stock received by Timothy Beal were bonus shares issued by the company rather thanoutright purchases on the open market.Iron Creek Capital 500,000 bonus shares

2011-09-14 13:56 PT - Miscellaneous

The TSX Venture Exchange has accepted for filing the company's proposal to issue 500,000 bonus shares to insider Timothy Beale in consideration of services rendered for the company. Shares will be released on the following schedule:Shares are subject to a four-month hold period. If Mr. Beale ceases to be employed by the company prior to the issuance of all the shares, the company will issue a pro rated number of shares based on the next instalment due to him, based on his date of cessation.

- Upon exchange approval, 100,000;

- July 1, 2011, 80,000;

- Jan. 1, 2012, 80,000;

- July 2, 2012, 80,000;

- Jan. 1, 2013, 80,000;

- July 1, 2013, 80,000.

Labels:

irn.v,

iron creek

Chart of the day is....

...GLD versus SLV versus GDX versus GDXJ, 10 day chart:

A bit of a sinkage for sure, but it has to be said that the stocks have done ok compared to their metals.

A bit of a sinkage for sure, but it has to be said that the stocks have done ok compared to their metals.

Labels:

chart

Thursday, September 15, 2011

Continental Gold (CNL.to) comes out with its resource

1) Here's how we kicked off this post dated 25th July on Continental Gold

"With decently sourced jungledrum rumours and heresay and whispers and all that jazz saying the Continental Gold (CNL.to) is about to release a 43-101 resource count for its Buritica project in Colombia of three million ounces of contained gold...."

2) Here's the link to the CNL.to NR of today which states that the Buritica property has an all-categories (M+I+I) 43-101 compliant resource of 3.13m oz gold.

3) Funny dat, innit? So $250/oz in-situ it is, Ari. DYODD, dude.

Labels:

cnl.to,

continental gold

Mercer Gold (MRGP.ob) and Rahim Jivraj

Check out the suit Mercer Gold (MRGP.ob) just slapped on Rahim Jivraj's tush right here. Two wrongs do not make a right, by the way.

Labels:

mercer gold,

mrg

Something we know about Great Panther Silver (GPR.to) (GPL)...

...is that the top management there really don't like that this humble corner of cyberspace talk about their insider share shares (and people, we got the emails to prove that). But honestly, I don't understand why that should be. I mean, shouldn't they really be proud of those sales? Take for example Robert Archer and the way he's cashed in 298,800 shares this last week or so and banked himself one.....million....dollars. It's pretty clear that he's not paid enough at the company and is deserving of the cash that comes from dumping a shitload of shares on helpless retail saps, no? After all, he's only due to be paid $500,000 cash by GPR.to in 2011 and who can scrape by on that kind of pittance these days?

So c'mon GPR dudes, turn over a new leaf! Shout out those heavy insider share dumpages so that the world can hear them and be happy that you can take advantage of this wonderful thing called capitalism.You know it makes sense.

Quiztime

Here we go with a few questions for this esteemed audience to ponder:

Answers on a postcard please to:

Otto Rock

Behind the bike sheds with a crafty ciggie

Al ber quer kay (right turn)

1) Is the Pope Catholic?

2) Will the sun rise in the East or West tomorrow morning?

3) Will the listing of Fortuna Silver (FVI.to) (FSM) on the New York Stock Exchange be beneficial to the company's share price?

4) Do bears tend to defecate in areas of large tree coverage?

Answers on a postcard please to:

Otto Rock

Behind the bike sheds with a crafty ciggie

Al ber quer kay (right turn)

Labels:

fortuna silver

Chart of the day is...

...of Rio Alto Mining (RIO.v):

Interestingly, its 52 week low is September 14th 2010 and its 52 week high is 14th September 2011.

Interestingly, its 52 week low is September 14th 2010 and its 52 week high is 14th September 2011.

Update: Would you like to read Ian Parkinson of CIBC on RIO.v and the rationale behind his new $4.80 target? Ok, click here.

Labels:

chart

Wednesday, September 14, 2011

TV stars

Look who's hanging at BNN tomorrow, Thursday 15th September:

1) Mickey Fulp is appearing on Andrew Bell's show tomorrow morning, where he's scheduled to talk uranium (betcha HAT.to gets a mention). Check listing for the exact time.2) Brent Cook has a full hour to annoy some company CEO or other on BNN's excellent Market Call format later that day. If I were you I'd ring or mail in with in with your question for the bearded one immediately.

Do yourself a favour and watch both segments, because listening to people who actually know about rocks is far more profitable than listening to the market charlatans who can only pretend they know.

Chart of the day is...

..Silvercorp (SVM) (SVM.to) ten day chart.

Splat!

Subscribers: You'll get a Flash update that mentions the action in this stock in a few minutes. Enjoy the rest of your day, people.

Update: RayJames defends SVM, link here.

Update 2: We understand that SVM will issue "a full rebuttal" (source quote) later this morning. This heard from two places now.

Update 3: Two developments: Firstly, SVM came out with its rebuttal this morning and you've probably already rad that, but it's here. Secondly, this is the website of the original anonymous short sellers. Here's how they start their presentation:

Update 4: Here's the BMO take on today's developments, as per Andrew Kaip (who called the first downmove a buy last week and did well by it).

Disclosure: As subscribers already know I'm long a very small amount of SVM and will hold them for the time being.

Update: RayJames defends SVM, link here.

Update 2: We understand that SVM will issue "a full rebuttal" (source quote) later this morning. This heard from two places now.

Update 3: Two developments: Firstly, SVM came out with its rebuttal this morning and you've probably already rad that, but it's here. Secondly, this is the website of the original anonymous short sellers. Here's how they start their presentation:

September 14, 2011

Our Questions About Silvercorp. (NYSE: SVM, TSX: SVM CN)

Situation Background

On August 29, 2011, we anonymously sent a letter to a number of parties including Ernst & Young (Silvercorp’s auditor) and the Ontario Securities Commission. We indicated that we planned to post some of our research on Silvercorp on the Internet and we included a preliminary copy of our research with that letter. On September 2, 2011, before we had posted any research, Silvercorp announced publicly that it had received a copy of our letter from Ernst & Young. Silvercorp published a press release in which it stated its response to certain of the matters raised in our letter and made reference to certain documents. In the release Silvercorp stated that a special committee of its board of directors has been established. We reviewed Silvercorp’s response, updated our analysis further, and are now posting our revised analysis on the Internet. On September 9, 2011, the media reported that the British Columbia Securities Commission had been made aware of our research and was “examining both the nature of the complaint and the allegations contained in [our] letter.” We have sent a copy of this Internet posting to the British Columbia Securities Commission, the Ontario Securities Commission, Ernst & Young and Silvercorp’s independent directors.

Update 4: Here's the BMO take on today's developments, as per Andrew Kaip (who called the first downmove a buy last week and did well by it).

Disclosure: As subscribers already know I'm long a very small amount of SVM and will hold them for the time being.

Labels:

chart

Tuesday, September 13, 2011

Geometry Problem 669: Triangle, Circumcircle, Incenter, Midpoint, Collinear points, Mind Map

Geometry Problem

Level: Mathematics Education, High School, Honors Geometry, College.

Click the figure below to see the complete problem 669.

Level: Mathematics Education, High School, Honors Geometry, College.

Click the figure below to see the complete problem 669.

What Scotia thinks of Hathor (HAT.to)

Right here below, and FWIW Scotia is calling it right imho (disclosure: your humble scribe is long HAT, smallish trading position)

Preliminary Assessment of HAT’s Roughrider – High Grade + Low Capex = Very Attractive Economics even Before Including the Far East Zone: This morning, Hathor Exploration (HAT-CN, not covered) released the much anticipated Preliminary Assessment for its Roughrider Uranium Project in the eastern Athabasca Basin of Saskatchewan. Scotia Mining Sales is eager to see the full study (to be posted on SEDAR within 45 days) but the summary of the results is very encouraging in terms of both the forecasted capital costs (only $468mm pre-production, including $172mm for Processing Facilities and a 25% contingency). Also, operating costs are very attractive at an estimated $14.44/lb U3O8 which compares very favourably to Cameco’s Athabasca operations and projects (i.e. $23.14/lb U3O8 at Cigar Lake and $19.69/lb at McArthur River ). The low costs are due to a) the proximity to existing infrastructure, b) the high grade nature of the deposit, which minimizes the mining rate and mill throughput. Both of these are features that contribute to making the Athabasca Basin the world’s most important uranium producing jurisdiction. Looking at the reported project economics, Scotia Mining Sales thinks the $60/lb U3O8 case is the most appropriate, which produces a pre-tax NPV7% of $769mm discounted back to the start of construction (or 32% IRR and 1.6 year pay back). It is important to note that this analysis does not include the Far East Zone which has yet to be included in the resource estimate (but which Scotia Mining Sales thinks adds 13-17mm lbs to the current ~58mm lbs resource). Scotia Mining Sales assumes a roughly 4 year permitting process with production beginning in 2020 after a 4 year construction period. Discounting all the way back to beginning of 2012, Scotia Mining Sales estimates a pre-tax NPV7% of ~$570mm, or roughly $4.50/HAT share, and suggesting significant upside beyond CCO’s current $3.75/sh bid for HAT. Including the Far East Zone in the resource boost Scotia Mining Sales’ 2012 NPV7% to $731mm or $5.85/HAT share. Conference call to discuss the PA is scheduled for 1pm EDT today: 1-877-353-9586. http://www.hathor.ca/s/NewsReleases.asp?ReportID=478741

A Flash update...

...has just been sent to subscribers, right at the opening bell on this beautiful and sunny Tuesday morning*.

Please be having nice day yes thank you yes.

*well, round this way at least

Mining PRs and the Ottotrans™, Part 45

Today's foray into the wild world of the junior mining news release turns its attention to Exeter Resources (XRC.to) (XRA) and this finely worded missive emitted by the company this very morning.

This is what they wrote:

Press Release Source: Exeter Resource Corporation On Tuesday September 13, 2011, 6:30 am EDTVANCOUVER, BRITISH COLUMBIA--(Marketwire -09/13/11)- Exeter Resource Corporation (TSX: XRC.TO - News) (AMEX: XRA - News) (Frankfurt: EXB.F - News) ("Exeter" or the "Company") is pleased to report that the Chilean government has granted the Company a 10,726 hectare water exploration concession. The concession provides a second potential water source for the Caspiche gold-copper project. The concession is located approximately 100 kilometres (60 miles) north of Caspiche, at an elevation of 4,700 metres above sea level.

The aquifer is within the same high altitude region of the Andes where other mining companies hold granted water rights. The source of the water is seasonal snowmelt trapped by volcanic barriers and which is considered unlikely to make its way to the coastal plains. Water harvesting from such a basin would not be considered to have a negative impact on present and future supplies relied upon by coastal communities.

The Company expects to initiate a water exploration program comprising field mapping, geophysics, drilling and pump testing during Q4 2011, weather permitting.

Applications for two additional water exploration concessions in the area are still being processed by the relevant government authorities. Following approval, exploration programs will be extended to cover these concessions.

A mine at Caspiche is estimated to require less than 100 litres/second for the initial heap leach gold phase of the mine, rising to as much as 1,000 litres/second for a full scale sulfide mining operation.

In addition to the water exploration rights reported in this release, on February 8, 2011 (http://exeterresource.com/pdf/2011_news/Exeter_news_110208.pdf) Exeter reported an option over water rights of 300 litres/second from local owners. The seasonal thaw in October will allow us to continue with the baseline water flow program covering these water rights started earlier this year.

Exeter has retained specialist consultants to develop a water balance in the area with the objective of demonstrating that the use of these water rights for a mine at Caspiche will be sustainable over the project life. This will provide a technical basis for an application to the relevant authorities for permission to proceed with the installation of the necessary pumping and delivery infrastructure.

Exeter is continuing to study the availability of water in the region and to negotiate with other parties for the purchase or rental of water rights. The Company and its consultants are taking a constructive approach to Caspiche's water needs and the overall sustainability of the water resources needed by the mining industry.

In addition, the Company is pleased to report that the Pre-feasibility Study for the Caspiche Project, including in-pit crushing and conveying of waste rock remains on schedule for completion before the end of 2011.

About Exeter

We got no water

Labels:

exeter resources,

ottotrans,

XRC.to

Chart of the day is...

...The Euro, dailies.

When you say "the dollar is strengthening", all you're saying is that the dollar is performing relatively better than the lump of crap that comprises a full 57.6% of the index you use to measure it.

Telling me "the dollar is strong these days" is like telling me a six year old kid is fast cos he beat a four year old kid over 50 metres.

Labels:

chart

Monday, September 12, 2011

Mexico industrial activity

This chart, taken from this new Sep 12th dataset out of Mexico's INEGI stats people, shows the development of five key industrial sectors to Mexico's economy since 2009. The lines show the year-over-year percentage change in electricity (generation/transmission etc), hydrocarbons production (oil + gas), mining (metallic and non-metallic, plus ancillary industries around mining), Construction (both residential type and civil engineering type) and manufacturing:

In a nutshell, mining and oil are lagging, meanwhile Mexico is building itself up nicely above ground. It also shows that the record prices being fetched at market for metals is the real reason for the flashy growth numbers we see in dollar terms, not any extra mining work being done.

Subscribe to:

Comments (Atom)