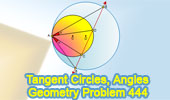

Click the figure below to see the complete problem 444 about Internally Tangent circles, Secant line, Chords, Angles, Congruence.

See also:

Complete Problem 444

Level: High School, SAT Prep, College geometry

As a Colombian, I feel elated to see this. This Mockus effect is due in part by the public repudiation of the wrongdoings of the incumbent:

-Mr. Uribe, trying to take active part in the presidential campaign, openly promoting Santos and disqualifying the other candidates.

-The growing outrage about the 'chuzadas' (phone tapping and espionage to selected members of the opposition and the supreme court).

-Santos ultimate responsibility in the case of 'falsos positivos' (extra-judicial killings of civilians to make them appear as guerrilla casualties).

-The failure of 'justicia y paz' process with the paramilitaries, where the victims are unlikely to get proper closure -justice and economic repair.

Let's hope this momentum carries through until the election day.

Interesting how inventory has shifted out of LME warehouses and over to Shanghai bonded ones, innit?

Interesting how inventory has shifted out of LME warehouses and over to Shanghai bonded ones, innit?

"Ecometals Limited ("Ecometals") has agreed to a further extension to the closing of the SPA with Alca Gold Limited ("Alca") and its financial backers for their acquisition of Ecometals' shares in Condormining Corporation S.A. and Condorview S.A. for US$9,000,000 to be satisfied in cash. Both parties have agreed their intention to extend the closing with cash payment on 23rd April, failing which Ecometals will terminate the Agreement."

"The closing payment was not made on 23 April 2010. However, Alca has requested a further extension supported by a proposal to make an immediate US$1,000,000 payment into an account with an escrow agent as a sign of their commitment to closing the transaction within 60 days. A non refundable payment of US$100,000 will then be transferred from the escrow account to Ecometals Limited and a further non refundable transfer of US$100,000 after 30 days. Both payments will be offset against the final purchase price if the closing transaction is completed. If the transaction is not completed, then the balance of the US$1 million will be returned to Alca."

first we have "oh my god we're all gonna die!!!" at the opening bell.

first we have "oh my god we're all gonna die!!!" at the opening bell.

"Greystar said the ministry wants the new Angostura EIA to adjust the occupied area to an elevation below 3,200 meters. As currently designed, almost all of Angostura's facilities and infrastructure are at a higher elevation, Greystar said, and half of the proposed open pit is above 3,200 meters.

"It said the request would require the Angostura project to be completely redesigned, "including identifying and acquiring new land positions to house displaced facilities and initiate new environmental base line studies." Greystar said it hasn't had the opportunity to determine the feasibility of redesigning the project, but that the requirement "will severely impact the project schedule and may have a material effect on its economic viability."

Greystar Resources Ltd. (the "Company") (TSX:GSL - News; AIM:GSL) announced that the Ministry of the Environment, Housing and Territorial Development (MAVDT) has requested a new Environmental Impact Assessment (EIA) to be filed in respect to the development of an open pit gold-silver mine at the Company's Angostura project in Colombia. MAVDT has requested that the new EIA conform to new regulation Law 1382 of 2010 (Modified Mining Code) which requires that mining and exploration activity must be excluded from the "Paramo" ecosystem.Paramo is an ecosystem that consists of mostly glacier formed valleys and plains with lakes, peat bogs and, wet and dry grasslands intermingled with shrub lands and forest patches. The definition to determine the area of Paramo is that established by the Alexander Von Humboldt Biological Resources Research Institute (www.humboldt.org) in Colombia. While the definition of Paramo is determined by fauna, flora and other ecological categories, it is also defined by elevation.

MAVDT has requested that the new Angostura EIA adjust the occupied area to an elevation below 3,200 metres. As currently designed, almost all the project facilities and infrastructure are at a higher elevation than 3,200 metres. In addition, half of the proposed open pit resides above 3200 metres. MAVDT's request would require the Angostura project to be completely redesigned: including, identifying and acquiring new land positions to house displaced facilities and initiate new environmental base line studies. At this juncture, the Company has not had the opportunity to determine the feasibility of redesigning the Angostura project to comply with MAVDT's request. However this requirement will severely impact the project schedule and may have a material effect on its economic viability.

The original Angostura EIA was filed with MAVDT on Dec 22, 2009 before the modification of the Mining Code on February 9, 2010. At the time of the filing, Greystar was led to believe that the Modified Mining Code would not apply to the Angostura project. The request by MAVDT for a redesign of the project and a new EIA was not expected or anticipated by the Company.

Greystar has begun the process of filing an appeal of the notification from MADVT. MADVT must respond to the appeal within fifteen (15) working days.

Greystar has worked diligently and to the highest environmental standards for more than 15 years to develop the Angostura project. The International Finance Corporation (IFC) is the Company's largest shareholder. To date, the Company has spent approximately CDN $135 million and the Company employs 350 people.

A Preliminary Feasibility Study (PFS) was completed describing all the areas of mining activity as well as the efforts made to minimize environmental impacts particularly in the Paramos. The PFS envisions a project with US$1 billion in capital expenditures and US$3 billion in operating expenditures over the life of the project. The project will employ 1,500 people during construction and 850 people during its 15 year mine life. The PFS was used to develop the EIA according to the terms of reference issued by the MAVDT.

Greystar is in the midst of completing a Definitive Feasibility Study (DFS) on the Angostura project that is expected to be published in the second half of 2010. In addition the Company has begun the process of securing US$650 million in project finance from international sources.

Greystar is committed to developing the Angostura project using best industry practices in social and environmental stewardship. Through its association with the IFC, the company has brought objective guidance to this commitment. Greystar will continue to work with the Colombian Government to demonstrate that the Angostura project can deliver exceptional economic returns for all Colombians while allowing the Paramos ecosystem to flourish.

Greystar will host a telephone conference call for investors and analysts on Monday, April 26th, at 8:00 a.m. PDT (11:00 a.m. EDT) to discuss the request by the Colombian Government for a new Angostura environmental impact assessment. Steve Kesler, Director, Fred Felder, Executive Vice President and Geoff Chater, Vice President Corporate Development of Greystar will take questions. The conference call may be accessed by dialing toll-free 1-866-223-7781 in Canada and the United States, or 1-416-641-6117 in the Toronto area and internationally. The conference call will be archived for later playback and may be accessed by dialing 1-416-695-5275 or 1-800-408-3053 and entering the pass code 7108410. The archived playback will be available until May 10, 2010 at 11:59 p.m. EDT.

About Greystar Resources Ltd.

There's a single big difference between the charts and it's marked up there. As for similarities, there are many (ok, one has been a 200% winner and the other a 300% winner...split hairs if you like). However it occurs to me that the biggest thing copper and oil have in common is that even though they are two commodities in great demand, the world tries to deny its addiction to them both.

There's a single big difference between the charts and it's marked up there. As for similarities, there are many (ok, one has been a 200% winner and the other a 300% winner...split hairs if you like). However it occurs to me that the biggest thing copper and oil have in common is that even though they are two commodities in great demand, the world tries to deny its addiction to them both.

This one, where the PDVSA press conference and supporting literature is examined and the obvious gov't pumping laid bare.

This one, where idiot anti-Chávez propaganda is made to look what it is: Stupid.

Hundreds of striking miners at Mexico’s Cananea copper mine said they will destroy the site if the government tries to dislodge them.

The union representing the striking miners, who seized Mexico's Cananea copper mine three years back, said explosives have been set to destroy the facility if they are evicted from the site.

The threat comes after Mexico’s Supreme Court upheld an earlier court ruling allowing mine owner Grupo Mexico to terminate the contracts of the strikers and hire new workers.

The miners first walked off the job at the Cananea copper mine three years ago over concerns about continues here

Thursday, 22 April, 2010 11:47Good morning, 11:47am and well into the trading day.

Camino Minerals (COR.v) may be offering us a quick, short-term trading opportunity today. However it must be stressed that this trade should be considered for risk-tolerant profiles only.

The background is this: COR.v (website here) is the spin-out from the recent successful buyout of Canplats by Goldcorp (GG). As part of the buyout deal, Canplats shareholders got shares in the newco company that is now known as Camino Minerals (COR.v), which has bundled together the assets not sold to GG and also has $10m in working cap to start it off, too. Its total shares out figure is 64,265,432.

Today is the first day of trading for COR.v and it has opened nearly 50% down from its nominal price of 49c. It is currently trading at 26c (bid 25c, ask 26c). Volume is very high at over 11m shares traded.

It seems to me (and also the thought of the person mentioned below who gave me the headsup this morning) that COR.v shares are trading down at high volumes possibly due to forced liquidations. There are many institutions that might have held the old Canplays (CPQ when it existed) but are not allowed to hold micro-cap penny stocks such as COR.v, therefore due to the nature of their funds they are obliged to liquidate.

This is the opportunity envisaged. At the current 26c, COR.v has a market cap of $16.7m. This is backed up by $10m in cash at bank. It also has a book of prospective assets. Finally, it's run by proven winners in the exploration game.

This seems like good odds to me, a good risk/reward scenario for this trappy game of exploration mining investment.

WARNING: Wwe're considering a very short term flip play here. Therefore the main caveat is that although 26c (mkt cap $16.7m) may look cheap today, the nature of selling patterns may make the stock even cheaper tomorrow. That's the main risk here.

The IKN Weekly in this style gives you a headsup on this risky, short term play. Be clear that this kind of trade is not for everyone. Go in with your eyes open.

Disclosure: I am not long yet but may take a position this afternoon. I will happily sell if a quick short-term profit is offered.

Final word. Toby Shute, an analyst over at The Motley Fool (RSS link here) is a site friend and smart at the investing game (well worth your while following him..esp strong at oil&gas companies). He gave me the headsup on the COR.v trading today and after consideration I think it's worth passing all the above on to the subscriber base. I want to make it clear that your author takes full responsibility for the call (i.e. if it goes wrong blame me and not Toby).

Best, O

1) He took his dosage like a man (far better than the normal whining from the analyst community, it must be said).We like Trevor Turnbull. And we very like Troy Resources. DYODD, dude.

2) Today he's re-rated Troy Resources again, upgrading and raising his target to CAD$2.50 (as reported on the DJNW wires, no link sorry)